19+ income on mortgage

Web The ceiling for one-unit properties in most high-cost areas is 822375. The amount of assistance is determined by the adjusted family income.

1545 Sheridan Blvd Lakewood Co 80214 For Sale Mls 7728381 Re Max

Were not including any expenses in estimating the income.

. Monthly payments on your new mortgage should be no more than 28 of your gross monthly income and your total. Web Have household income at or below your states program requirements. Most state programs limit eligibility to households with less than 150 of the median income in.

REVISED 060822 When fluctuating income is used to. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. Apply See If Youre Eligible for a Home Loan Backed by the US.

Web In this example you shouldnt spend more than 1680 on your monthly mortgage to stick with the percentage of income rule for mortgage. FHA loan limits have also increased in 2021 rising to 356362 in most areas and 822375 in. Plus how PPP and unemployment benefits are handled by lenders.

Ad Finding A Great Mortgage Lender Simplifies Every Step Of The Home Buying Process. Web Your debt-to-income ratio is the total of all your monthly debt payments divided by your gross monthly income. Web Frequently Asked Questions.

This article examines what is at risk for one. Web Homeowners and renters. Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online.

Last week the 30-year fixed APR was 717. Find all FHA loan requirements here. Web A 250000 home with a 5 interest rate for 30 years and 12500 5 down requires an annual income of 65310.

Apply See If Youre Eligible for a Home Loan Backed by the US. Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Well Help You Estimate Your Monthly Payment.

Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Depending on your credit history credit rating and any. Apply now or contact our team.

Web If you are a homeowner with a government-backed mortgage and experience COVID-19-related financial hardship you can pause mortgage payments for. Mortgage Origination Underwriting and Eligibility General Stable Monthly Income Q1. If the COVID-19 pandemic has caused job loss income reduction sickness or other issues that impact your ability to pay your home.

Web 15 hours agoMortgage rates made substantial gains yesterday as financial markets underwent a classic flight to safetynbsp. Ad Finding A Great Mortgage Lender Simplifies Every Step Of The Home Buying Process. Web A common rule of thumb is the 2836 rule.

Find all FHA loan requirements here. Web This ratio says that your monthly mortgage costs which includes property taxes and homeowners insurance should be no more than 36 of your gross monthly income. For example say your total monthly debt payments for a.

Web Lenders set new requirements for self-employed mortgage borrowers during COVID-19. Ad Are you eligible for low down payment. Ad Compare Home Financing Options Online Get Quotes.

Web COVID-19 Mortgage Relief If youve been affected financially by the COVID-19 pandemic and you own a single-family home with a federally backed or FHA-insured. This involves selling riskier assets like. Great selection of home loans.

Web To determine how much income should be put toward a monthly mortgage payment there are several rules and formulas you can use but the most popular is the. Ad A full range of mortgage programs to support any goal. Web According to your income details the amount you are eligible to borrow is between.

Web Qualified mortgages must meet minimum debt-to-income DTI ratio requirements with regular income documentation. 9000000 and 12000000. Web The unprecedented shutdowns caused by COVID-19 threaten to break multiple links in the mortgage chain.

Need To Know How Much You Can Afford. Ad Are you eligible for low down payment. Web Payment assistance is a type of subsidy that reduces the mortgage payment for a short time.

Web The average APR for the benchmark 30-year fixed-rate mortgage fell to 714 today from 720 yesterday. Web A stated income mortgage is a loan for borrowers who qualify using alternative documentation such as profit and loss statements or bank statements. This ensures that you have enough.

Homeowners Now Eligible For Financial Help Wltx Com

How Much Income Do You Need To Buy A House Credible

Secondary Mortgage Market The History Of Fannie Mae Mckissock Learning

When Should You Get Life Insurance

Income To Mortgage Ratio What Should Yours Be Moneyunder30

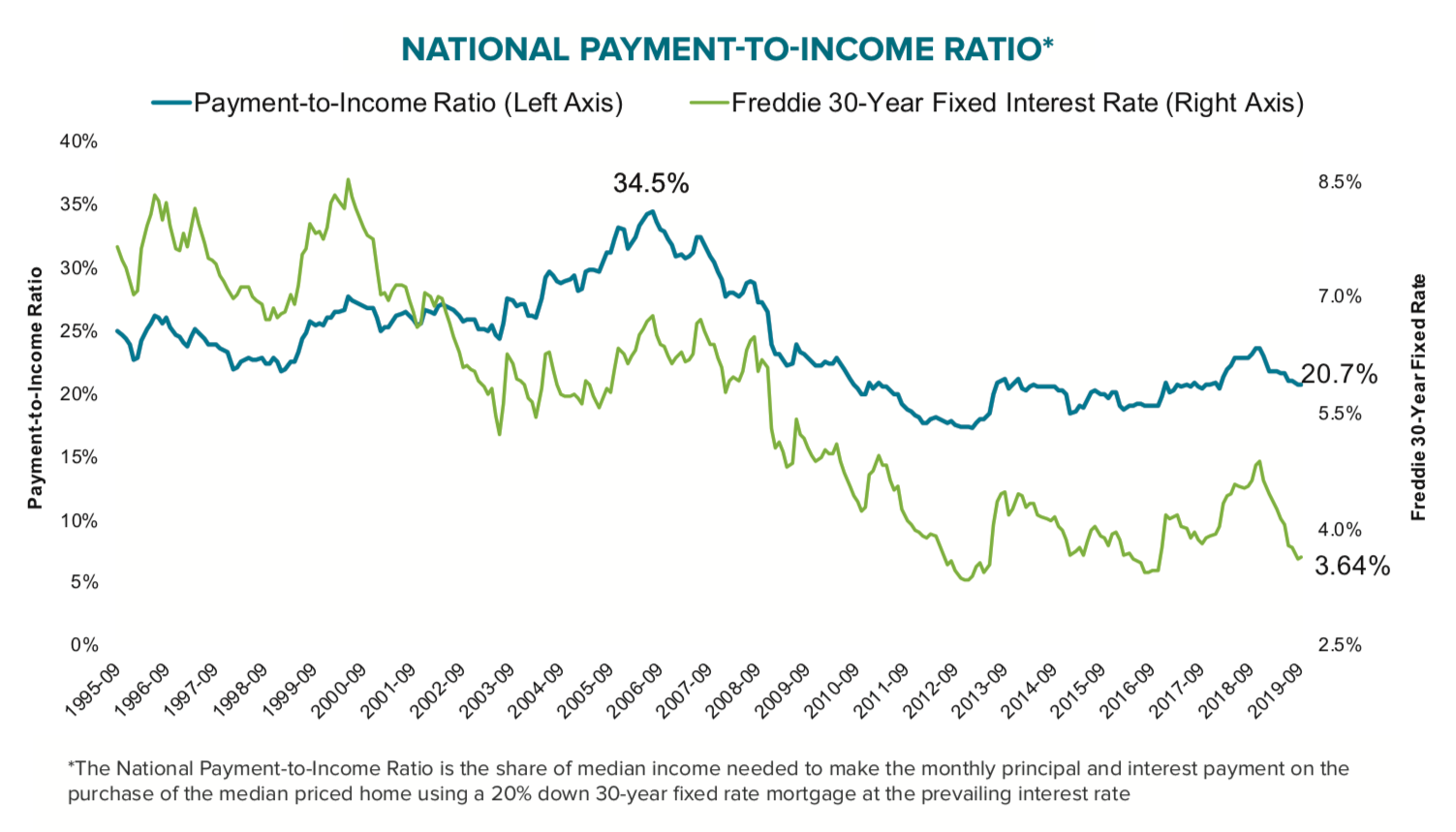

Thanks To Mortgage Rates Buying A Home Is The Most Affordable It S Been In Almost Three Years Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Rismedia S December Digital Magazine Mckissock Learning

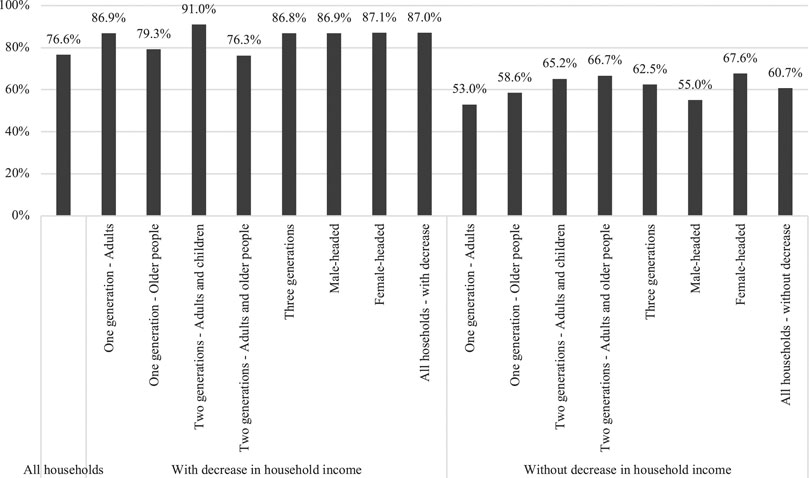

Frontiers Household Coping Strategies During The Covid 19 Pandemic In Chile

The Financial Situation Of Households During The Covid 19 Crisis This Time It Is Different

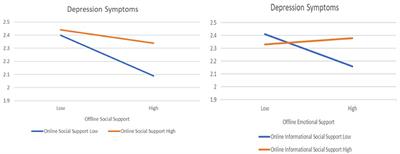

Frontiers Social Media Social Support And Mental Health Of Young Adults During Covid 19

25 Best Financial Service Near Duluth Georgia Facebook Last Updated Feb 2023

Mortgage Broker In Willetton Canning Vale Atwell Mortgage Choice

Principality Of Andorra 2021 Article Iv Consultation Press Release Staff Report And Statement By The Executive Director For Principality Of Andorra In Imf Staff Country Reports Volume 2021 Issue 107 2021

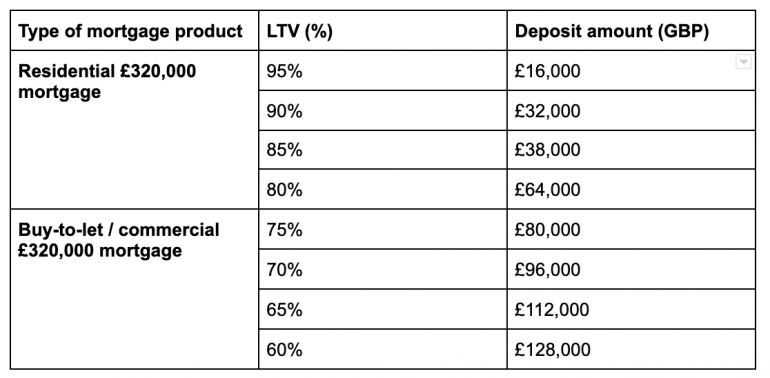

Will I Be Approved For A 320 000 Mortgage The Mortgage Hut

Loss Of Income From Covid 19 Can I Apply For A Mortgage

Findings On Happiness And Possessions

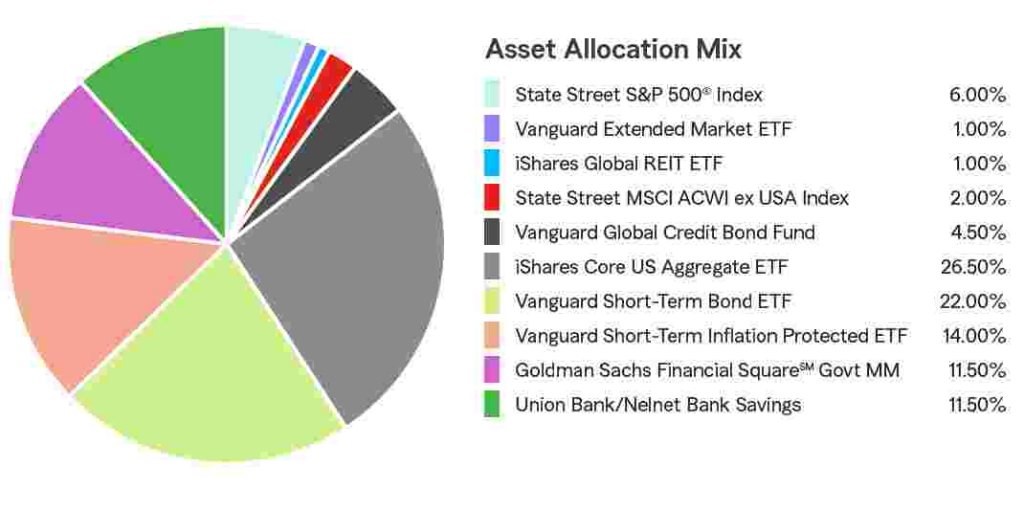

State Farm 529 Savings Plan Age Based 19 Plus Portfolio State Farm